While the pace of technological advancement and innovation remains something to behold, its diverse range of applications are often misunderstood or unappreciated. Take the concept of autonomous cars, for example, which while having the potential to reduce road accidents by an estimated 90% have largely been derided and treated with suspicion.

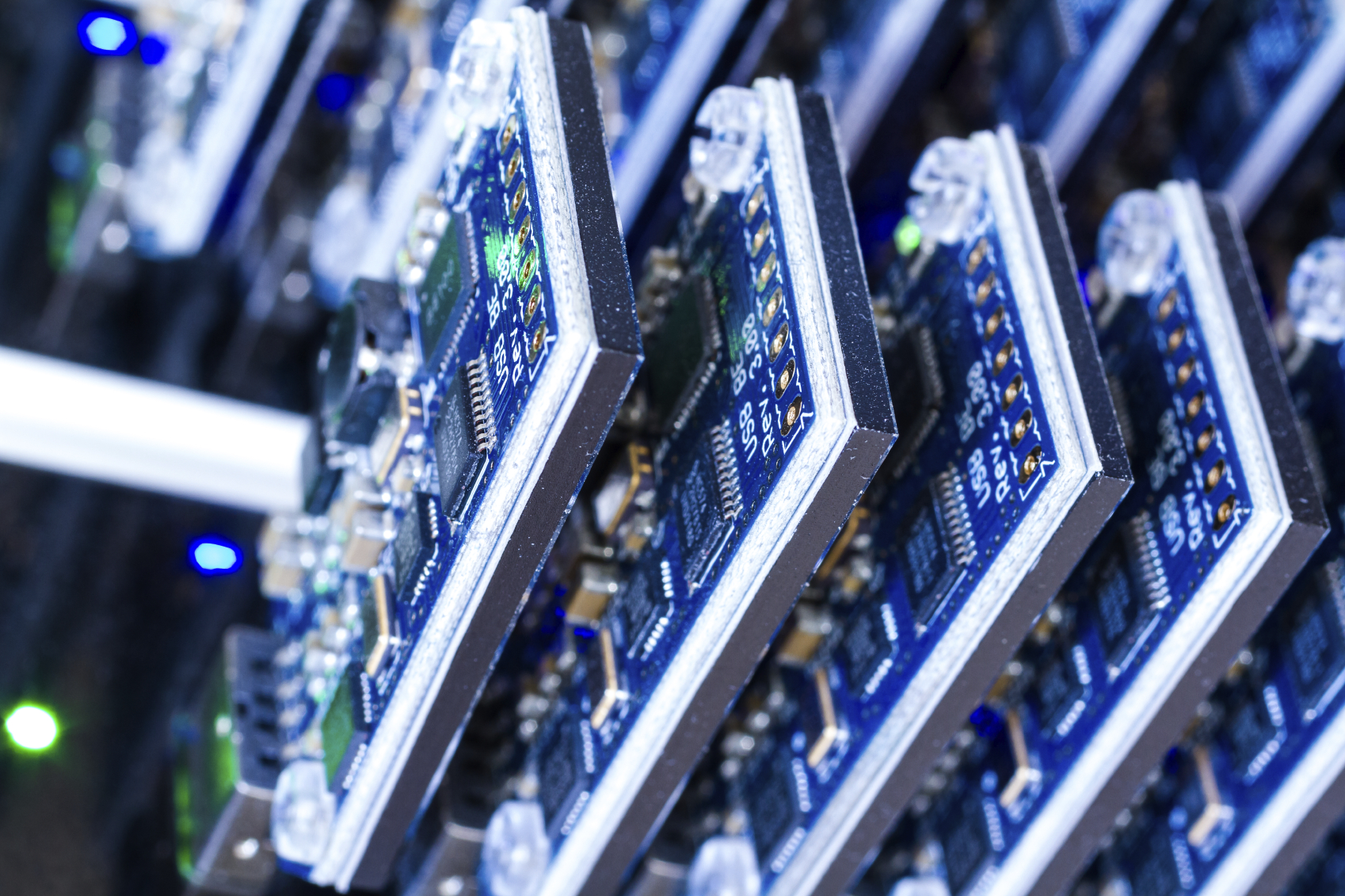

In some instances, the notoriety of an application actually detracts from the merits of the technology behind it, and this is certainly true in the case of Bitcoin. Despite being underpinned by advanced and diverse Blockchain technology which actually has multiple applications in the consumer mainstream, Bitcoin has continued to dominate the headlines throughout its tumultuous and often turbulent history.

The rise, fall and rise of Bitcoin

While London-based PR firm CCgroup has recently explored the numerous and surprisingly diverse range of potential Blockchain applications, there is far more media mileage in discussing the considerable peaks and troughs of Bitcoin. The standard bearer and market pin-up for crypto-currencies, Bitcoin has enjoyed a short but volatile history that makes for a truly fascinating case-study.

Make no mistake; however, Bitcoin is now on an upward swing after a period of significant turbulence. This has culminated in the decision of game-streaming platform Steam to accept the crypto-currency, in a move aimed at engaging players located in Brazil, China and India. More specifically, Bitcoin transactions and the supporting Blockchain technology will be integrated into the platform, making it accessible to more than 100 million global users. This move reflects the international scope and scale of Bitcoin, while it also highlights the tamper-proof and universal nature of Blockchain.

This is the type of development that Bitcoin innovator Satoshi Nakamoto had in mind when he launched his white paper back in October 2008, which underlined his vision for a peer-to-peer, electronic currency that could be used globally. It looked like this would never come to fruition after a challenging period during the currencies infancy, however, as a perceived lack of regulation and an unfortunate association with Silk Road (and illicit marketplace for drugs trading) undermined its appeal. Now increasingly popular and the subject of significant regulation from various international bodies, Bitcoin may be on the verge of realising its true potential.

What Next for Bitcoin

Having emerged from a grand vision and sunk to the brink of extinction, Bitcoin is finally being established as a legitimate and keenly regulated currency. Last year saw the introduction of New York’s ground-breaking BitLicense, for example, which is recognised as the world’s first digital currency-specific regulatory authority. We can subsequently expect it to become increasingly popular in the digital marketplace, while bricks-and-mortar retailers and other establishments may also begin to consider Bitcoin as a viable payment method.

While Bitcoin’s renaissance and journey towards legitimacy will continue to be well-documented and widely celebrated, however, the underpinning Blockchain technology will probably go unheralded. It is this technology that makes Bitcoin easily accessible across the globe, however, meaning that it is also primarily responsible for the currencies growing appeal.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin