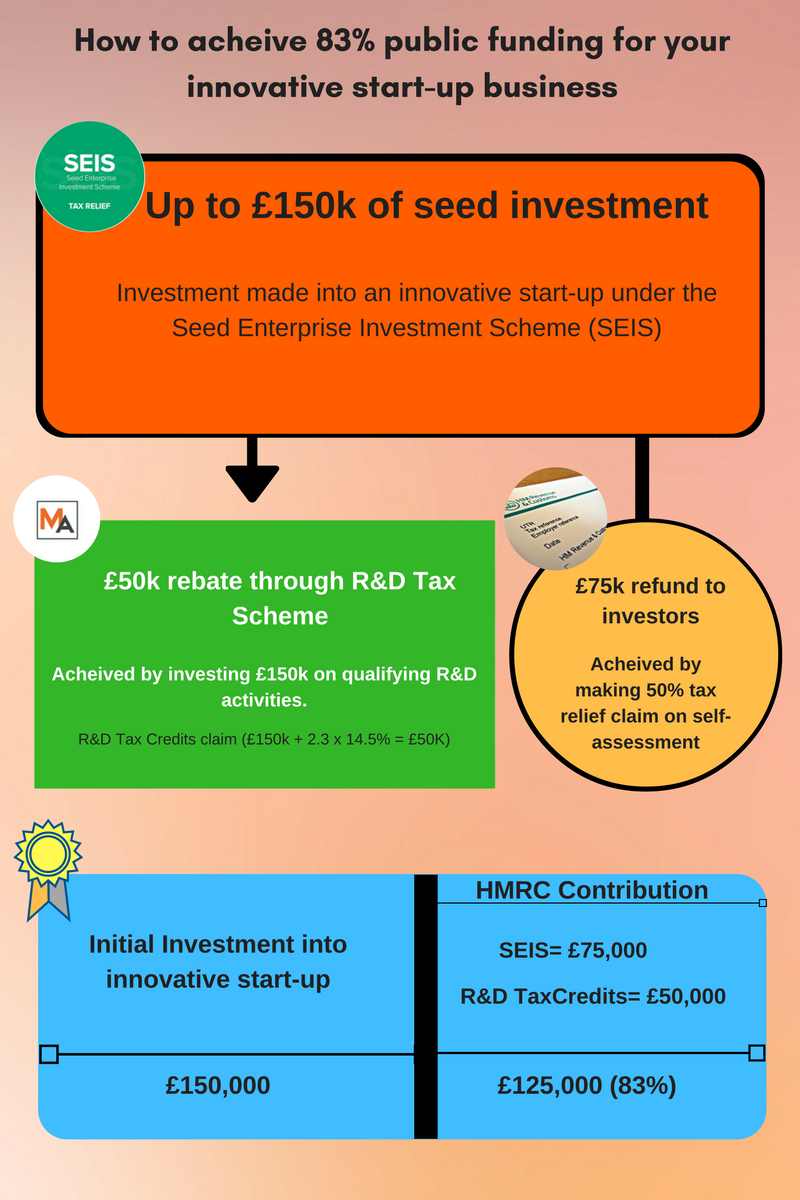

If you are an entrepreneur and love to venture into the unknown and push the boundaries of technology then mixing R&D Tax Credits, with help from Myriad Associates, and the Seed Enterprise Investment Scheme (SEIS) could provide you with up to 83% of your funding requirements. The latest tax incentive offerings from HMRC are unprecedented. Both R&D Tax Credits and SEIS are very generous in their own right, however when they are combined together they make an incredible funding opportunity for an innovative start-up business.

The funding recipe

Serves 4+ investors & a hungry innovative start-up

Ingredients

- 1 start-up company or alternatively a company that has been trading for less than 2 years

- Investors (ideally 4 or more)

- 1 SEIS certificate (available from HMRC)

- Directors that have a passion to venture into the unknown

- A sprinkling of dedicated employees that engage in development activities

- 1 specialist tax consultancy

- 1 R&D Tax Relief claim (per year)

Instructions

- 1 Firstly, set up a new company or use an existing company that has been trading for less than 2 years, has total assets of less than £200,000 and employees 25 people or less.

- Add a SEIS certificate. You will be able to obtain this by making an application to HMRC (with the support of your tax consultant)

- Add 4 investors that each invest £37,500 in return for a 25% shareholding in the new venture. Under SEIS each investor would be able to reclaim 50% income tax relief (£18,750) on their investment irrespective of their tax rate. This means that a total of £75,000 is received back through the self-assessment return. It is important to structure the shareholdings so that no shareholder has more than 30%. A company can raise up to £150,000 in total under the SEIS incentive.

- Invest the £150,000 in development activities by adding and mixing employees that have a passion to push the boundaries of technology forward

- Bring the development activities to boil and then leave to simmer for up to 12 months (could be shorter if you need to get your hands on cash quicker!)

- Add a specialist R&D Tax Relief consultant that will analyse, prepare, optimise and then submit your R&D Tax Relief claim to HMRC

- Continue with your development activities whilst your R&D Tax Relief claim is cooling off with HMRC

- Finally, invite your investors to dinner so that they can get a taste of the £50k (£150,000 x 2.30 x 14.5%) worth of R&D Payable Tax Credits before agreeing to re-invest it in the business to support further development activities. Alternatively the investors can treat you to dinner as they would have received £75k back through their self-assessment returns.

- So in sum from the original investment of £150k into the start-up innovate business, a total of £125k (83%) has been paid out by HMRC.

We hope that this recipe has given you a little taster of the excellent funding opportunities that are available from HMRC. All that is required is a little bit of upfront tax planning to ensure that your business venture is structured to take advantage of these very generous tax incentives.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Solana

Solana