The average UK homeowner moves out of their parent’s at 21, lives in seven houses and spends £26,295 on redecorating over their lifetime, according to new research.

And the typical mortgage will take 20 years and nine months to pay off – costing a total of £134,864.82 in the process.

Homeowners will end up living approximately 66 miles away from their childhood home on average – and will only live in TWO cities their entire life.

While a total of £14,138 will be spent on hiring removal vans, paying the legal fees and paying the stamp duty during the typical Brit’s lifetime.

UK adults will reside in two rental properties before getting on the property ladder for the first time.

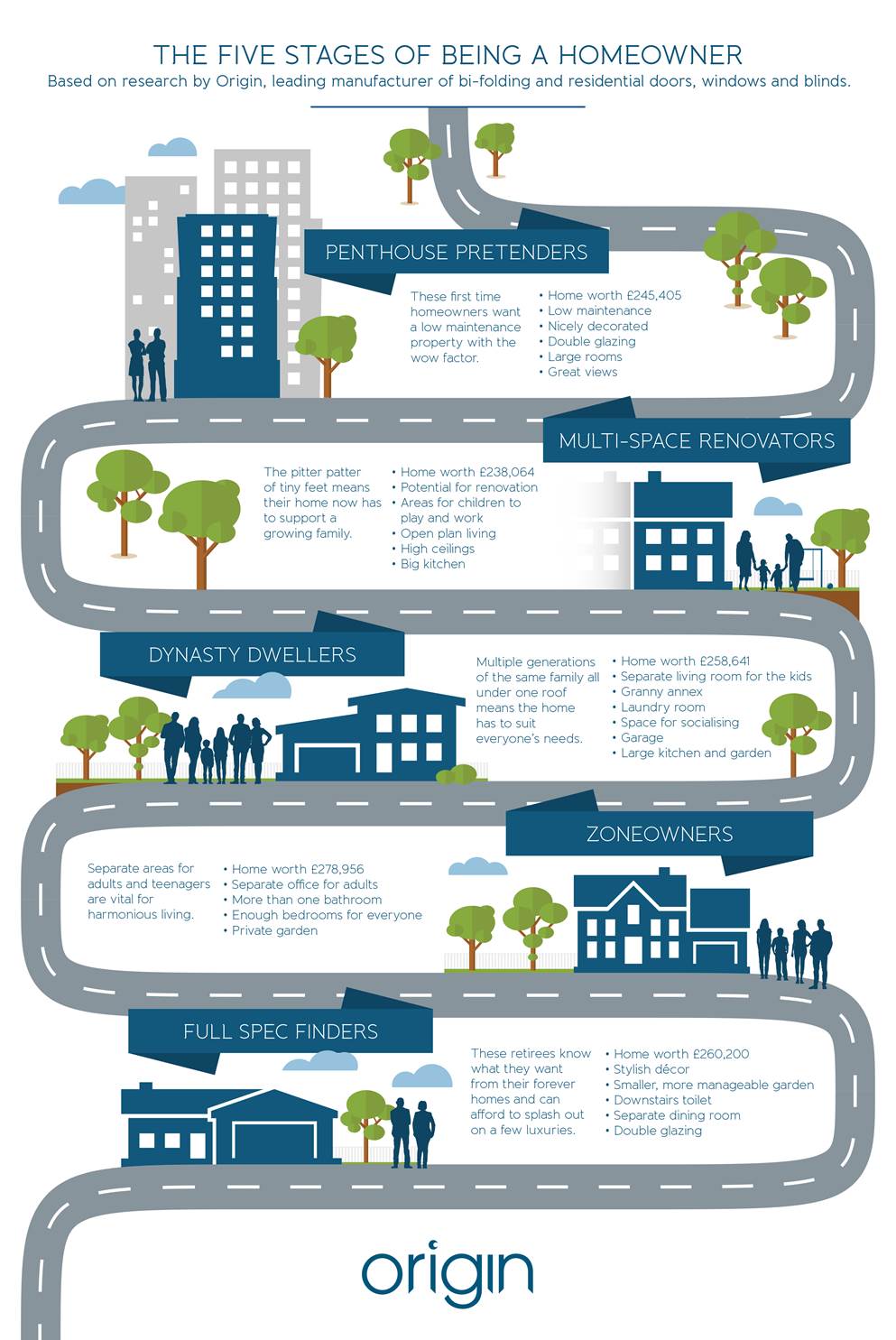

The research of 2,000 UK homeowners was commissioned by Origin, manufacturer of bespoke aluminium bi-folding doors, residential doors, windows and blinds.

It looked at the different stages of property buying for the average British homeowner and how property aspirations change over time.

Ben Brocklesby, Director at Origin, said: “With the cost of moving so high, we have seen that families now choose to improve their current homes, rather than move.

“Many years ago, a home would be for life, but that changed and people started moving as their needs changed – whether it be as a result of new job or starting a family.

“However, today we are seeing a resurgence of people choosing to renovate and improve their current property so it fits with their needs without incurring moving costs.”

Typically, it takes four months and three weeks to get settled in to a new home – while over half of adults described moving home as the most stressful thing they’ve ever done.

On average, respondents will contribute towards two separate mortgages over their lifetime, and will typically look to downsize age 56.

The average UK property is estimated to be worth £249,127 on average among those polled – while the typical mortgage is £542.41 per month.

Of those who have ever had a mortgage, 39 per cent have paid it off, with the largest proportion of them – 27 per cent – aged 55 and over.

More people – 29 per cent – live in properties built before the 1950s than from any other period.

The average UK home has three bedrooms, while eight in 10 adults own a home with off-road parking and over half own a house with a garage.

The most popular style of interior is ‘modern’ followed by ‘English country’ and ‘minimalist’.

Seven in 10 homeowners jointly own their property with their partner and a fifth received money from their parents to help them get on the property ladder.

A third of home owning Brits currently live in a semi-detached property, over a quarter live in a detached house and 15 per cent live in a terraced home.

The research also explored what UK homeowners of different demographic groups consider to be most important about their homes.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin