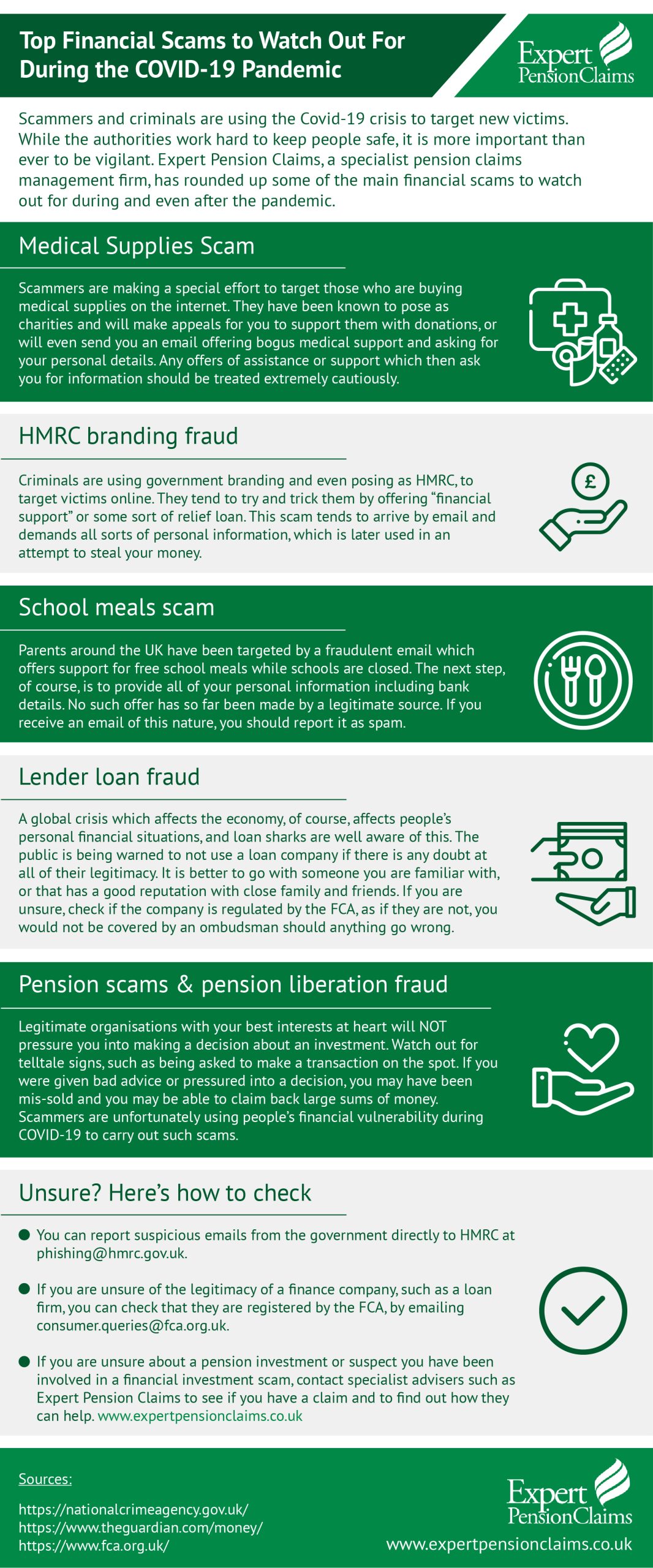

COVID-19 has presented many challenges for businesses and

individuals all over the UK, particularly those who are vulnerable. The elderly

and those considered high-risk have been advised to isolate themselves during

this difficult time, and unfortunately, financial scammers have used these new

social distancing measures as a platform for a new wave of financial scams.

From pension scams and lender loan fraud, to scams

surrounding school meals and medical supplies, there is a chain of financial

scams going around that you should protect yourself and your family members

from during the COVID-19 pandemic.

COVID-19 scams to look out for

Protecting yourself from financial scams

The National Crime Agency has released a 3-step approach to

protecting yourself and those you love from scams during COVID-19. This process

includes 3 simple steps that are highly effective.

- Stop – Take a moment to stop and think before you part ways with any money or any other valuable information. Don’t be afraid to tell a caller you’ll call them back.

- Challenge – Do you suspect a hoax? Reject or ignore it immediately.

- Protect – Report the scam as soon as possible to Action Fraud and contact your bank if you think you’ve fallen victim to a COVID-19 financial scam. You can report any potential spam emails to the government directly by sending them to phishing@hmrc.gov.co.uk.

Additionally, you should always check if financial advisors

are registered with the FCA before deciding whether or not to invest your

hard-earned money.

What to do if you’re caught up in a COVID-19

scam

If you’ve already been caught out by one of these scams,

you’re certainly not alone. COVID-19 has raised the pension fraud threat level

and the UK’s National Cyber Security Centre (NCSC) said it took down over 2,000

online coronavirus scams in March 2020. Thankfully, there are actions you can

take to claim back any finances lost.

If you’ve fallen victim to a scam, such as a financial

investment scam, you should contact your bank immediately. More often than not

scams are detected too late to reverse any decisions – and that’s where an

investment claims company can help.

Organisations like Expert

Pension Claims can help you claim compensation for any financial

mis-selling you might have fallen victim to, including any pension scams that

occurred during COVID-19.

You can of course make a claim yourself either directly to

the adviser or the Ombudsman for free, but Expert Pension Claims, a specialist

claims management company, has recovered over £5 million for their customers

since 2012 and could help resolve any case where miss selling has occurred.

It’s never too late to claim back what is rightfully yours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin