In these ‘stagflation’ times, it’s difficult to know where you can really make a return on your cash. This is a time when most people want to play it safe, and hold onto what they have. Yet others, this is a time of speculation.

In recent times, there has been a lot of noise about speculative cryptocurrencies. However, an asset which has been a lot steadier – and a lot more profitable for many – is nothing technological or newfangled. In fact, it’s an item that’s almost as old as time itself – watches.

Of course, not all watches make a good investment. But research from Luxe Watches shows that many luxury watches have performed as exceptionally good investments over the past five years.

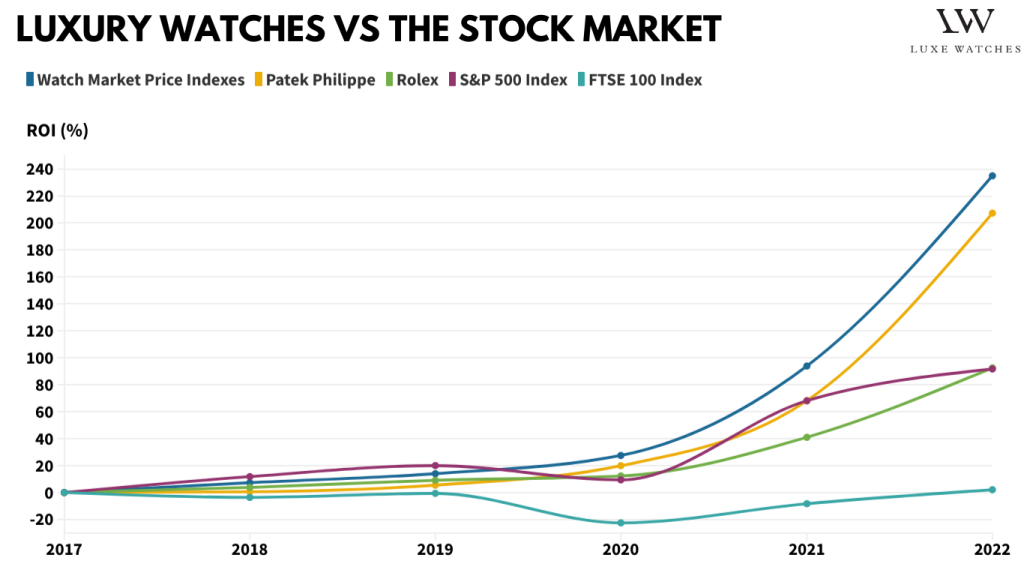

In fact, the numbers show that many luxury watches have not only increased in value over the past 5 years – they have actually outperformed other asset classes, including the S&P 500.

Better than the stock market?

The S&P 500, an index which tracks the USA’s 500 biggest publicly traded companies, is seen by many as the safest and best place to invest your money for strong, reliable returns. However, the data suggests that investing in the luxury watch market has significantly higher returns over the past five years. On average, Rolex watch prices have increased around 90% over five years – similar to the S&P 500. However, Patek Philippe watches have dwarfed the S&P 500s gains, with over 200% returns.

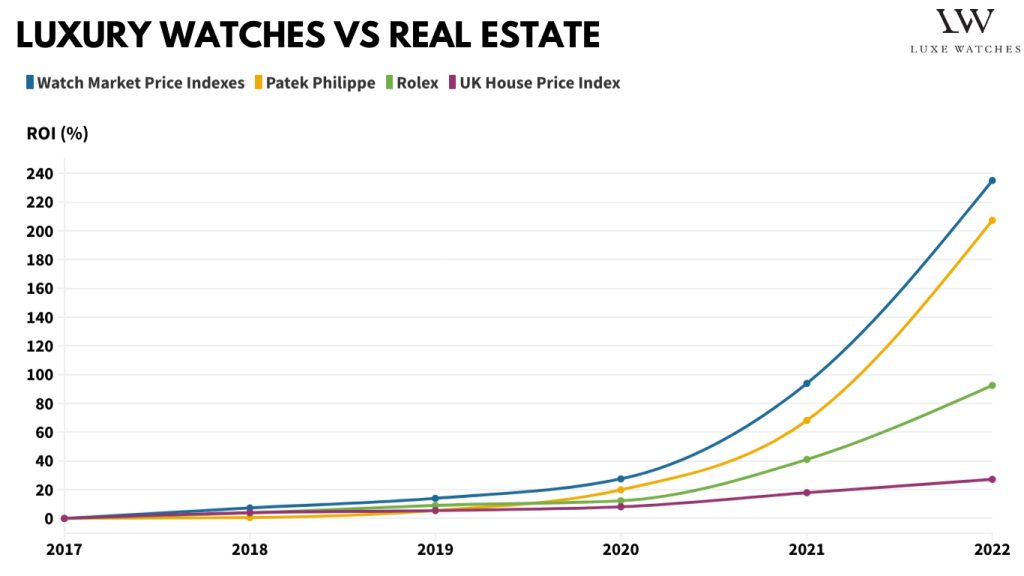

A better investment than real estate?

The property market has almost always been considered as a safe bet. That might be true now, and it has certainly been true in the past. However, the data is clear that for those astronomical returns, luxury watches outperform real estate. The UK House Price Index demonstrated just over a 20% return over the past five years. However, many Rolex watches increased in value around 90%.

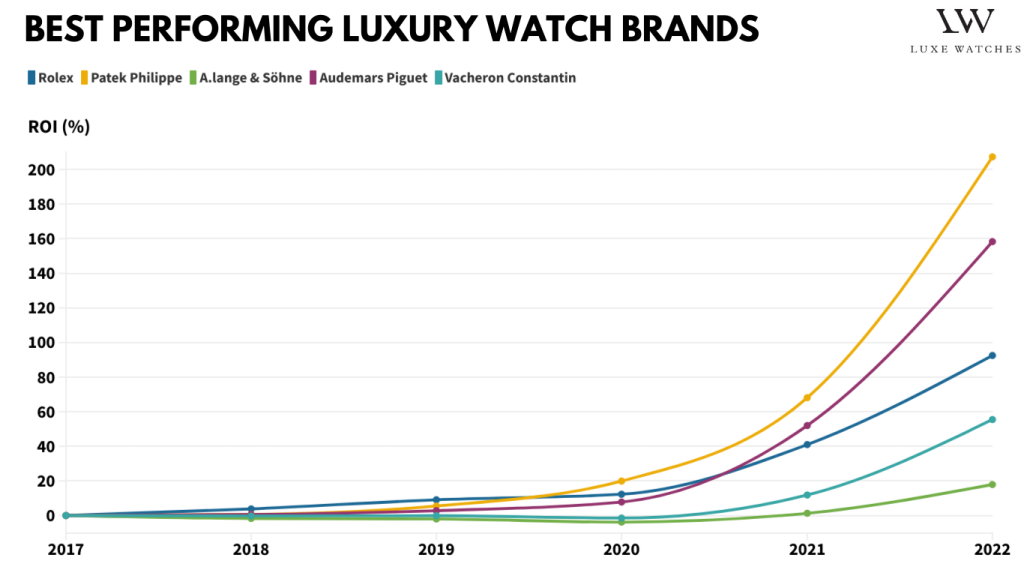

Which watch brand is best?

Rolex is the best-known luxury watch brand out there. However, it is not the highest-performing watch brand in terms of its investment value. That title goes to Patek Philippe.

The Rolex brand is recognised around the world, and the data shows that Rolex investments, with an average ROI of 93%, outperformed most other asset classes – including real estate and the S&P 500. That’s certainly not bad going!

However, Patek Philippe is the winning brand in terms of its investment value. With an ROI of 207% over the past five years, it leaves even Rolex in the dust. The second place honours go to Audemars Piguet, which yielded 158% on average.

Not all luxury watch brands can claim to share this outstanding price performance. Vacheron Constantin watches produced an ROI of 55%, and A.Lange & Söhne an ROI of 18% over the past five years. That’s certainly not bad, although it pales in comparison to the staggering returns from Patek Philippe.

As inflation continues to rise, it’s hard to know how the prices of any asset class will look in the next five years. But if the last five years are anything to go by, luxury watches remain in high demand, with rising prices that reflect that demand.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin