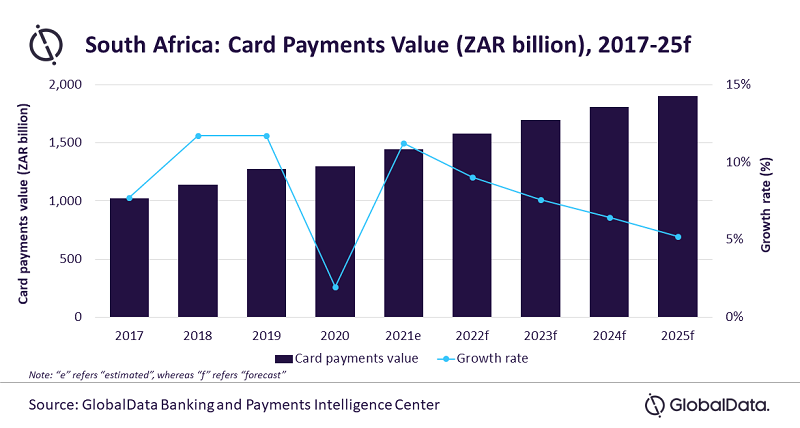

The South African card payments market is set to grow at a compound annual growth rate (CAGR) of 7.1% between 2021 and 2025 to reach ZAR1.9 trillion ($119.2 billion) in 2025, forecasts GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘South Africa Cards and Payments: Opportunities and Risks to 2025’, the South Africa card payment market registered a subdued growth of 1.9% in 2020, as the COVID-19 pandemic forced consumers to cut down on commercial spending. However, with the gradual recovery in economic activities, improving payment infrastructure and rising contactless and e-commerce adoption, card payments are expected to rise by 9.1% in 2022 to reach ZAR1.6 trillion ($99 billion).

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Although South Africa remains a cash-driven society, the country’s payments landscape is steadily shifting towards electronic payments. This can be attributed to the combined efforts of the government and financial institutions to boost financial awareness through the launch of financial literacy programs, the provision of basic bank accounts, and the expansion of payment card acceptance among retailers.”

The country’s economic growth contracted in 2020, with GDP registering an annual decline of 6.43%. Consequently, the government announced stimulus packages worth around $33.4 billion (8.19% of GDP) to address the country’s deteriorating economic situation and provide liquidity support for banks, businesses, and individuals. These measures are aiding the recovery of the country’s economy, which in turn is supporting card payment growth.

Sharma continues: “Though the COVID-19 pandemic has impacted consumer spending, it has also highlighted the importance of non-cash payment methods, pushing the use of card payments in the country.”

The preference for convenient and seamless payments has soared in South Africa during the pandemic, with an increasing number of consumers and merchants embracing digital payment methods for their purchases. As a result, South Africa’s leading banks increased the contactless payment limit from ZAR200 ($12.54) to ZAR500 ($31.35), supporting the payment card market’s growth.

Sharma adds: “South African consumers are now more comfortable using payment cards for e-commerce purchases. According to GlobalData’s 2021 Financial Services Consumer Survey*, debit and credit cards accounted for over a third of all online spending in the country. A rise in the e-commerce market will also drive the usage of cards for payments.”

*GlobalData’s 2021 Financial Services Consumer Survey was carried out in Q1 and Q2 2021. Over 52,742 respondents aged 18+ were surveyed across 42 countries.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin