Introduction

Bitcoin is a decentralized digital currency formed in 2009 by an unknown person or group of people using the pseudonym “Satoshi Nakamoto.” It does not rely on a central authority like a government or bank, and transactions are verified on a peer-to-peer network. Bitcoin has become gradually popular in recent years and is now accepted by many merchants and businesses worldwide.

Since its inception, Bitcoin has undergone several changes and has seen a lot of volatility in its price. It first gained traction in 2011, when it started being used in online transactions. Since then, it has become a popular form of payment, with more businesses and merchants accepting it. It has also become a popular investment vehicle, with many investors looking to capitalize on the potential of cryptocurrency.

Bitcoin works on a blockchain, which is a digital ledger that is used to record transactions. Transactions are noted on the blockchain and are verified by the network. The blockchain is maintained by a computer network that uses a proof-of-work algorithm to solve complex mathematical equations and confirm transactions. This process is known as “mining,” and miners are rewarded with Bitcoin for their work.

Overview of Changes in Bitcoin Over the Last Few Weeks:

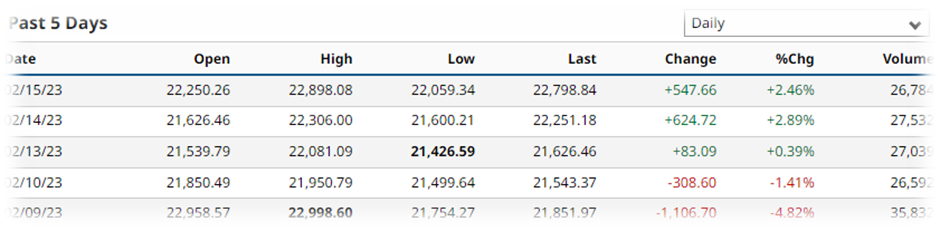

Over the last few weeks, there have been several changes in the value of Bitcoin and its use. The recent upwelling in the value of the cryptocurrency has been attributed to several factors, including increased institutional interest, increased demand from retail investors, and the halving of the rewards miners receive for mining new blocks.

Overview of Key Events:

Several important events preceded the recent surge in the value of Bitcoin. In mid-May, the US Office of the Comptroller of the Currency (OCC) issued a letter approving banks and other financial institutions to use stablecoins to settle payments. This was followed by a statement from the US Securities and Exchange Commission (SEC) stating that Bitcoin and Ethereum were not securities. These two events helped to increase the legitimacy of cryptocurrencies, and the value of Bitcoin surged as a result.

Impact of Events on Bitcoin:

The two events mentioned above significantly impacted the value of Bitcoin. The OCC’s letter increased the legitimacy of cryptocurrencies and institutional interest in the asset, increasing the price. The SEC’s statement that Bitcoin and Ethereum were not securities also helped increase the demand for these two cryptocurrencies, further pushing the price.

Analysis of the Recent Changes in Bitcoin:

Technical Analysis of the Recent Changes:

We used several technical indicators to analyze the recent changes in the value of Bitcoin. We found that the price was uptrend and had broken out of a long-term resistance level. We also observed intense buying pressure, and the RSI indicator showed that the market was overbought.

Fundamental Analysis of the Recent Changes:

We also conducted a fundamental analysis of the recent changes in the value of Bitcoin. We found that the increased institutional interest and the SEC’s statement positively impacted the cryptocurrency price. We also observed that the demand for Bitcoin has increased significantly as more people are looking to invest in the asset.

What’s Next for Bitcoin?

It is hard to expect what will happen next with Bitcoin, but it is clear that cryptocurrency is gaining traction and is becoming increasingly popular among investors and businesses. With increased institutional interest and the SEC’s statement that Bitcoin and Ethereum are not securities, the demand for cryptocurrency will likely continue to grow shortly.

Conclusion

In conclusion, the recent changes in Bitcoin have been driven by several key events, including the US Office of the Comptroller of the Currency’s letter approving banks and other financial institutions to use stablecoins to settle payments and the SEC’s statement that Bitcoin and Ethereum are not securities. These events have positively impacted the price of Bitcoin, and the cryptocurrency has seen a surge in value over the last few weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin