Success in the highly competitive forex landscape is built on fine margins and capitalizing on small windows of opportunity. At the core of the industry for institutional players in an effective reporting format that can help traders keep on top of market performance and emerging trends. But how can institutions excel in their reporting?

The world of forex continues to grow at a substantial pace. In 2022, the FX market size reached $753.2 billion, while it’s expected to grow at a CAGR of 7.2% to $1.14 trillion by 2028.

Such impressive figures point to an industry that’s full of opportunities for institutional traders, but how can industry players use data to bolster their performance and capitalize on their prospective profit margins? The answer lies in reporting, and thanks to innovations in the availability of data within forex, reporting is becoming more powerful than ever.

How to Utilize Forex Reports

Forex reports come in many shapes and sizes and are available from a range of sources. The most popular places to find FX reports include:

- Trading platforms: While most FX trading platforms offer real-time market data and live news feeds that include reports, the quality and level of detail can vary significantly.

For traders, it’s essential to keep on top of market trends. It’s for this reason that key forex players like MetaQuotes have developed an industry-leading suite of reporting tools for its flagship MetaTrader 5 product, which includes a more holistic analysis of factors like profit/loss, long/short positions, and breakdowns by symbol.

- Brokerages: Most brokerages also offer forex reports as standard among their suite of trading services. These reports are often compiled by market expert analysts who offer insights and trading recommendations for users.

- Financial news platforms: In addition to this, financial news websites can also offer a range of forex reports. These are usually the work of journalists and analysts who can offer a fresh perspective on financial markets.

These sources can offer a wide range of insight into shaping your own FX reports and will help you to share essential information throughout your institution. By blending the right tools, you can build holistic views of your performance and the industry as a whole.

Building Effective Reports

Your forex reporting can draw on vast reservoirs of information that cover both your trading performance and wider market conditions.

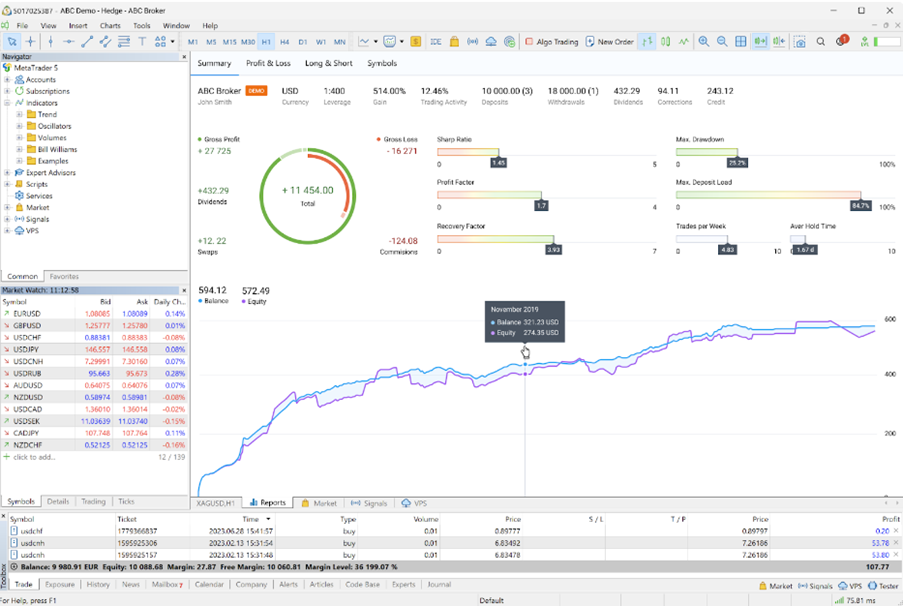

Using MetaTrader 5’s new reporting innovation, it’s possible to bolster your level of institutional efficiency through a fully redesigned statistics section that’s full of actionable insights into your trading history.

The reporting tool features six sections starting with the Summary page, and featuring Profit & Loss, Long & Short, and Symbols, among other rich information.

These optimization tools are perfect for bolstering your reporting and offer colour-coded information to help make the wealth of available insights more accessible to all relevant parties.

With the Summary section providing a comprehensive overview of account data, overall profit and loss, deposits and withdrawals, balance, growth and dividends graphs, and plenty more actionable information, it serves as a great starting point for your reporting approach. It can help to better understand your performance through supporting data.

In addition to this, Profit and loss reports provide a more granular view of your profitable and losing trades in a way that can be divided by types of trading, such as manual, copy, or algorithmic trading, and it can be analyzed by deal, percentages, or categorized over a variety of time frames.

Compiling Comprehensive Reports

For the most effective reports, it’s worth combining your trading performance with wider contextual information. To do this, you can compile reports that cover your analysis in a forensic manner, as well as more fundamental analyses that can offer a deeper understanding of overall performance and potential.

To do this, consider drawing on different forms of forex reporting. One of the best contextual reporting tools comes in the form of economic calendars which offer more information about upcoming economic events like central bank meetings, economic data releases, and political events.

Many economic events can have a significant impact on the performance of certain forex trading symbols, and this deeper level of contextual analysis can be a great means of building a more comprehensive report.

Economic calendars can be contextualized further through fundamental analysis reports. These offer an overview of economic and political factors that can influence the forex market. Such reports can take macroeconomic indicators into account, such as the ever-newsworthy impact of inflation and interest rates, to provide a more holistic view of the market.

Market analysis reports can also offer a larger market overview that takes factors like trends, patterns, and price movements into account. These reports are often compiled by experienced analysts who can offer a fresh and reliable market perspective.

Your approach to reporting can also be enhanced by utilizing technical analysis reports. Technical analysis includes symbol price movements and chart patterns which can help underline trading opportunities or to better highlight trading strategies. These reports can be bolstered further through trading signals that can help prompt relevant parties when certain market conditions are met.

The Importance of Effective Reporting

In a forex market set to grow at a CAGR of 7.2% over the coming years, institutions must be alert to the market opportunity in front of them.

With the growing availability of refined reporting tools, it’s becoming easier than ever to gain a comprehensive understanding of your trading performance and to act on the insights they provide.

On an institutional level, this can help stakeholders to better understand your strategy and the results that you’re achieving. With an unparalleled quality of insight, your institution will be stronger, better aligned, and more sustainable as you continue to grow and build on your KPIs.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin