Real-World Assets and institutional trading platform tanX has processed 11m transactions and over $2B in trading volume over the past year.

Trading platform tanX recently achieved a significant milestone, processing a billion dollars in quarterly spot trading volume across 3 million transactions in Q2 2024, a 70% increase from the previous quarter. This accomplishment highlights the growing trust and confidence in decentralized trading platforms.

Several factors have contributed to tanX’s growth in 2024. The platform has introduced various product upgrades, including strategic partnerships with multiple Layer 2 scaling solutions. This expansion allows users to import assets from a wider range of networks, ensuring fast order execution and low fees. Additionally, tanX has employed strategic initiatives like trading competitions and the launch of their loyalty program, SALT points, to incentivize user participation.

The new spot Bitcoin exchange-traded funds (ETFs) have been highly successful, collectively attracting over $30 billion in assets under management. In Q2, these spot Bitcoin ETFs set a record with more than $64 billion in average monthly trading volume. Despite this growth, the need for a decentralised, secure, compliant, and transparent trading infrastructure remains crucial for institutional investors.

Following the collapse of FTX, crypto traders are increasingly seeking decentralized, non-custodial, and safer methods for executing orders and storing assets. This trend underscores the rising interest in decentralized crypto exchanges (DEXs). TanX, an orderbook spot DEX on Ethereum, leads this transformation by offering a robust platform that ensures compliance, regulation, and asset transparency for institutional clients through their institutional liquidity lines.

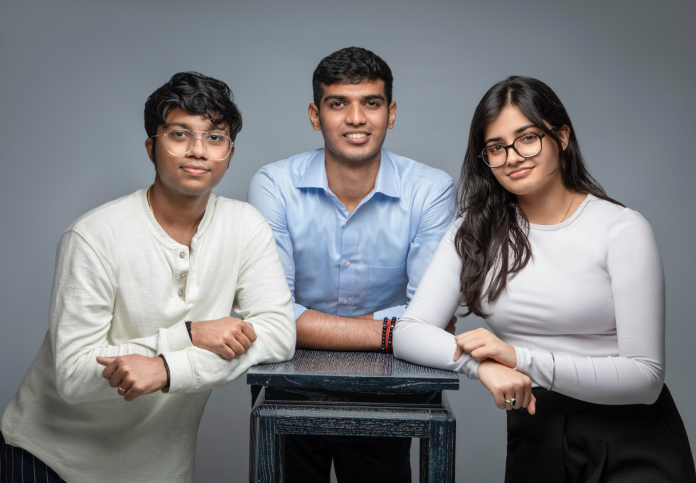

Bhavesh Praveen, co-founder and CTO at tanX, commented: “TanX addresses critical problems faced by both institutions and users in DeFi. I’m incredibly proud of our accomplishments and excited about the future. We are working on many new features that will help traders and institutions generate yield while maintaining full custody of their funds, preventing scenarios like FTX. We’re shaping the future of finance with our hybrid exchange engines, and I couldn’t ask for a better team to be on this journey with.”

The debate over DEXs versus CEXs is well-known. CEXs offer a familiar experience for investors, particularly those accustomed to stock exchanges, and often provide a more user-friendly interface. However, DEXs offer self-custody, allowing users to retain full ownership of their crypto. TanX bridges these two worlds with a hybrid operational model, enabling CEXs to integrate tanX’s solution for non-custodial trading while retaining the existing user experience.

Vikram, founder of Giottus Exchange, commented: “tanX brings a new perspective by bridging the centralized and decentralized space, delivering high-performance trade throughput and security. For institutions concerned about KYC-compliant trades, it doesn’t get better than tanX in the decentralized exchange space.”

In the current climate, where many exchanges face regulatory scrutiny in the U.S. and allegations of canvassing breaches and money laundering in France, compliance is paramount. While DEXs are not required to adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, they face risks of misuse.

TanX addresses this issue by offering institutions geo-fencing and KYC-routed orders, ensuring trades are executed only with known counterparties. Shaaran Lakshminarayanan, co-founder and CEO at tanX, commented: “Our goal at tanX is to catalyze institutional adoption in the digital asset space and onboard the next $100 billion in institutional crypto inflows into the market.”

TanX is a venture-backed trading platform that raised $16.5 million (at a $100 million valuation) from investors including Pantera Capital, Elevation Capital, Starkware Ltd, Spartan Group, Goodwater Capital, Upsparks Ventures, Protofund Ventures, and angel investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Toncoin

Toncoin