Virtual Assistant career – vital skills and qualities for becoming a specialist

People who own a business choose to hire a virtual...

Utility Warehouse gets their hands dirty with Green Initiatives

Image credit: ecolife.zone https://www.ecolife.zone/ If you...

Bitcoin Futures Legitimise Cryptocurrencies

Bitcoin futures trading on the Chicago Board Options...

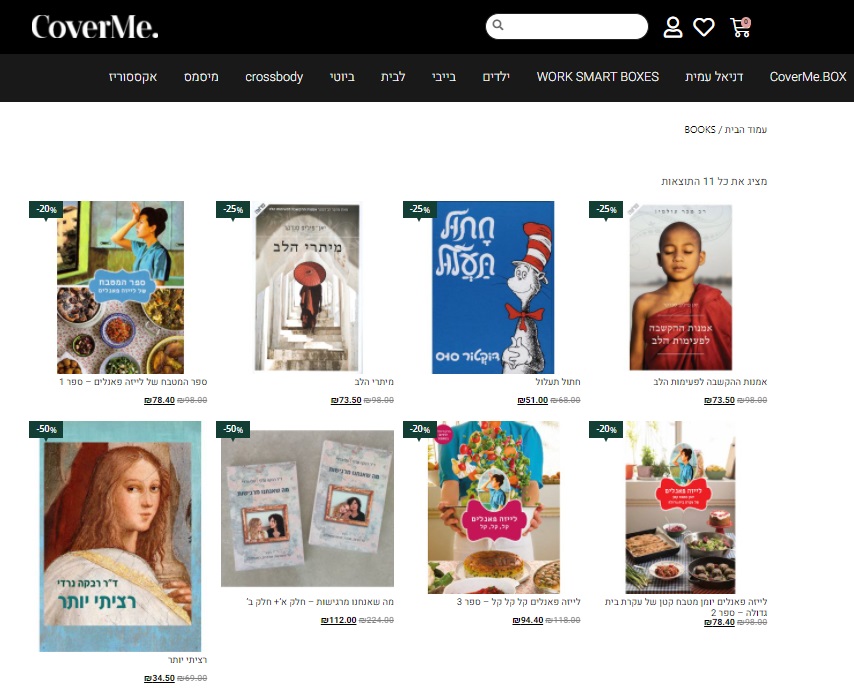

Liat Kourtz Oved Offers Your Favourite Books on CoverMe (www.coverme.co.il)

“Water Your Mind” – Liat Kourtz Oved (Owner of CoverMe)...

Important Areas to Consider When Designing Your Home Office

Your home office needs to be perfect according to your...

Top 8 Best Sun Holiday Parks in South West England

What factors should you consider while selecting your...

From outdoor markets to vaccine factories: How shipping containers are boosting post-pandemic recovery

One of the reasons repurposed shipping containers are...

Imminet – Do you Want to Immigrate to Australia? Making it Simple

Are you thinking about leaving your home country? Plenty of...

All About Prohormone Supplements Nuances

In the world of fitness and bodybuilding, people usually...

Guide to Choosing Natural Product Brands

CBD gummies are gaining popularity among gummies fans. They...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin