SPAIN BUCKET LIST: THINGS YOU MUST DO WHEN VISITING SPAIN

Spain is a safe bet for a peaceful vacation, with beautiful...

Is a telephone answering service really worth the investment?

The relationship between customers and businesses is quite...

How secure is your business phone’s wifi hotspot?

Creating a Wifi hotspot using your business phone can be an...

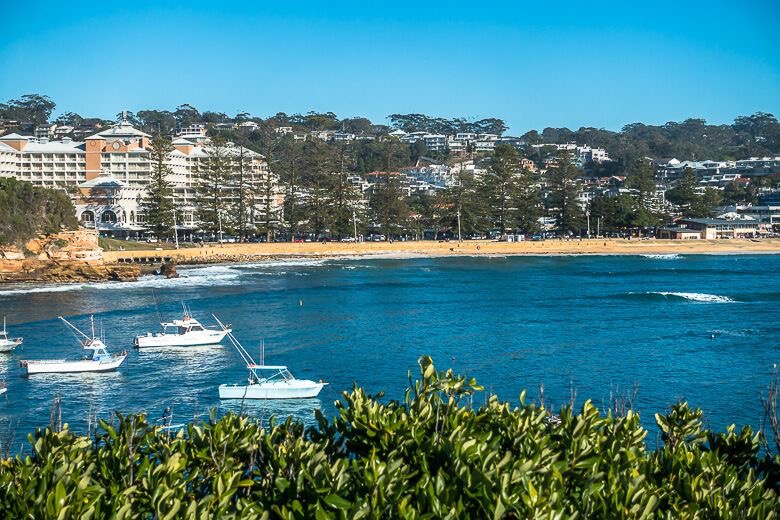

Andrew Lazarus Sees Real Estate Success Along Central Coast

Within the Sydney real estate industry, philanthropist and...

Areas of the UK that would take the longest time to save up for an average UK wedding

It’s no secret that planning a wedding can be extremely...

Here Is How Much SMEs Could Save On Ink Cartridges

Unmanaged printing costs might account for 1-3 % of an...

Exploring The Top Trends In The Printing Industry

Globalization and digitization are two developments that...

Financial App Development: Fresh Ideas and Best Practices

Fintech app development can be a daunting task. A good...

Benefits of hiring a private taxi when travelling for business

As the world is starting to open up its borders once again...

Top 3 Sites To Buy TikTok Likes And Followers At Affordable Prices

Nowadays, TikTok has become a shining social media space...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin