Here’s Why UK is a Great Startup Business Destination

Startups and multinational companies choose to start doing...

Alcohol Withdrawal: Everything You Need to Know

Alcohol withdrawal can be a serious, sometimes dangerous...

Want to learn Spanish abroad? Check out this top 10 cities and start planning your next trip

Learning Spanish can be a wonderful experience and if you...

FxPro Minimum Deposit: Key Facts

A minimum deposit limit is one of the key choice factors...

What Are the Best US Forex Brokers?

In the USA, the Forex market is scrupulously monitored and...

Adrian Fox Bahamas Helping Citizens Of The Bahamas During Covid-19

Dr. Adrian Fox, the initiator of Island Luck, is a resident...

Discord: The Rising Chat App; What You Should Know

Discord is the latest, and one of the most popular, chat...

2 Ways to Make Sitting in Front of the Computer More Pleasant When Working Long Hours

It’s a fact of life these days that many individuals...

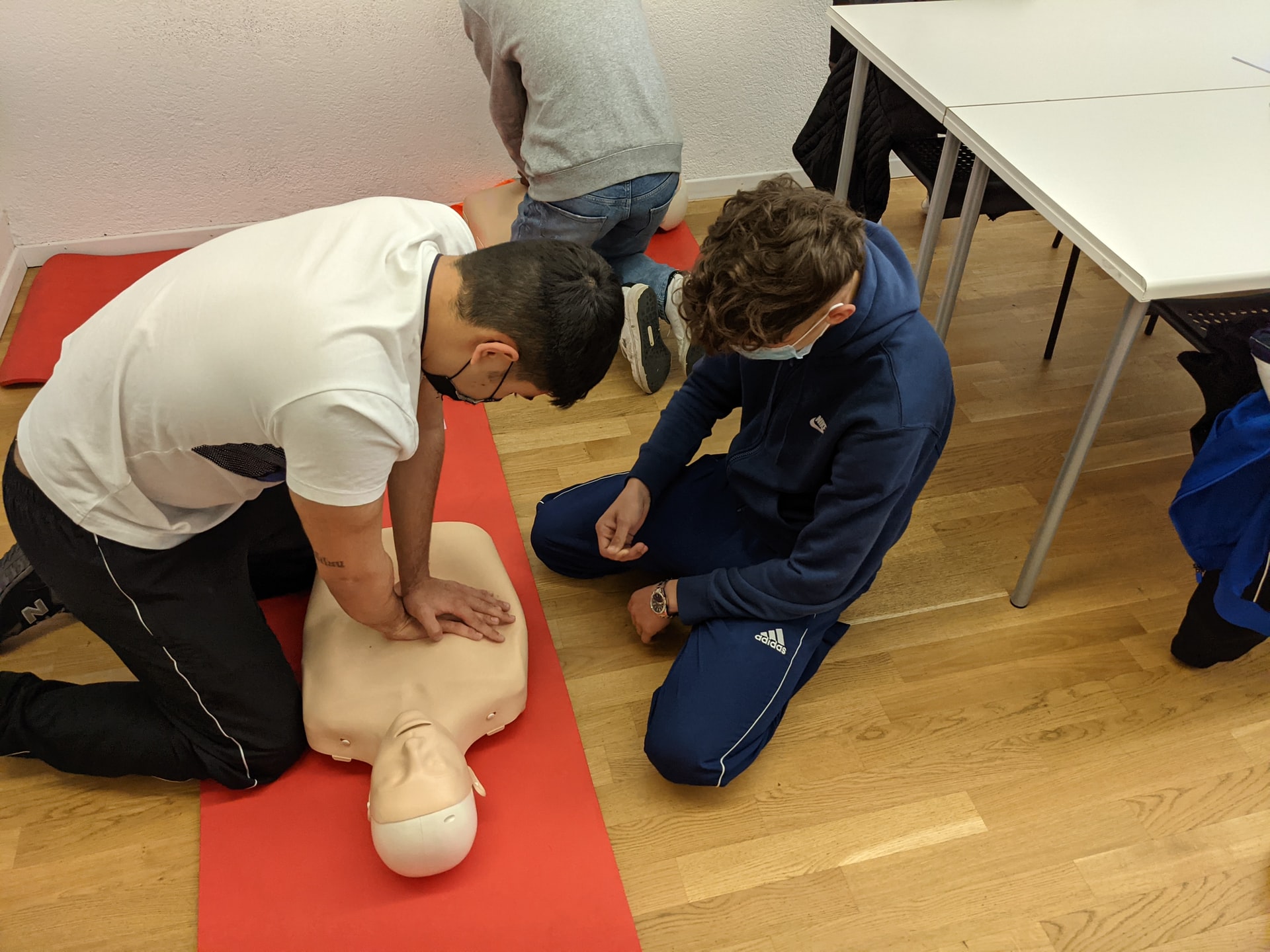

What is NEBOSH and why is it important?

Nowadays, there may be high risks in your workplace like...

To Make Real Money with an iOS App, You Need to Offer Entertainment, Gaming, or Dating

By the end of 2021, Statista estimates that mobile...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin