GORE AG on commercial office hubs of the future

The global pandemic brought office life to its knees, and...

Technology has opened up the forex market to a whole new generation of traders

The foreign exchange market is the world’s largest, and...

How much quality of wigs helps to stay confident?

With regards to shopping on the web, a great many people...

6 Tips and Tricks For Using a Mind Mapping Software

A picture speaks a thousand words. Based on this idea, mind...

Bitcoin Mining Is A Threat To The Environment

Not everything has been positive during this latest rally...

5 Best Automotive Technologies of 2021

Advancements in automotive technology have resulted in new...

How eSports organizations make money?

The E-sports industry is well known for its show and...

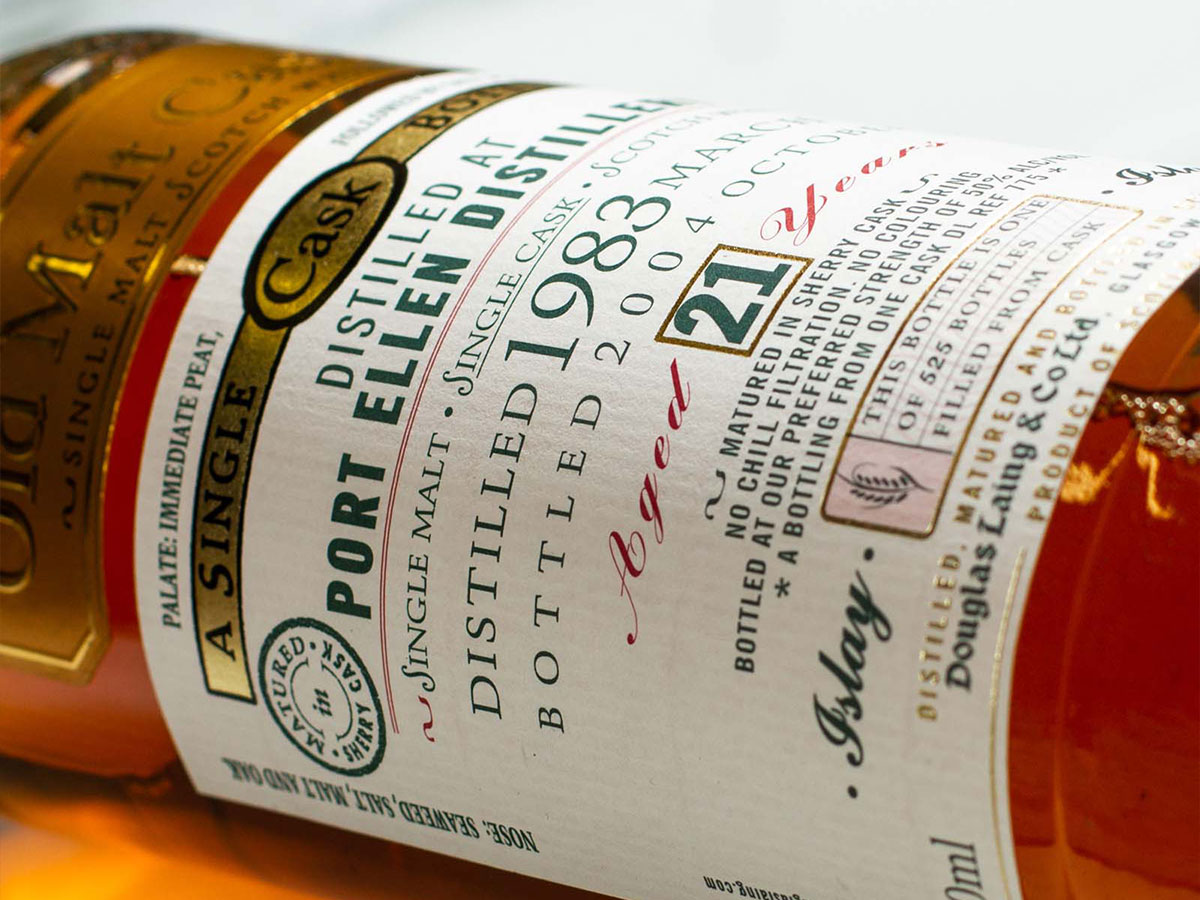

Cash In Your Cupboard; Is Your Bottle Of Whisky Worth £30 or £10,000?

Forget Faberge, if you are looking to find some hidden...

5 profits of artificial intelligence in project management (PM)

The Institute of project management (2019) review proves...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin