Partnership Between Nigus International and AXISCADES to Deliver Nigeria’s First Premium Aviation MRO and Training Centre

Nigus International and AXISCADES Technologies Limited have...

Racehorse share ownership: Last-minute Christmas gift from £25 with Racing Club

Hungerford, UK. December 8th 2025 – Christmas is just...

The Hidden Value in Your Jewellery Box: Understanding Hallmarks and Gold Standards

Most people have a drawer somewhere filled with jewellery...

Discovering the Value of Specialty Roasted Coffee Beans

Specialty roasted coffee beans are becoming a favorite...

Trustpilot Shares Plunge Amid Short-Seller’s Explosive Extortion Claims

Trustpilot Shares Plunge Amid Short-Seller’s...

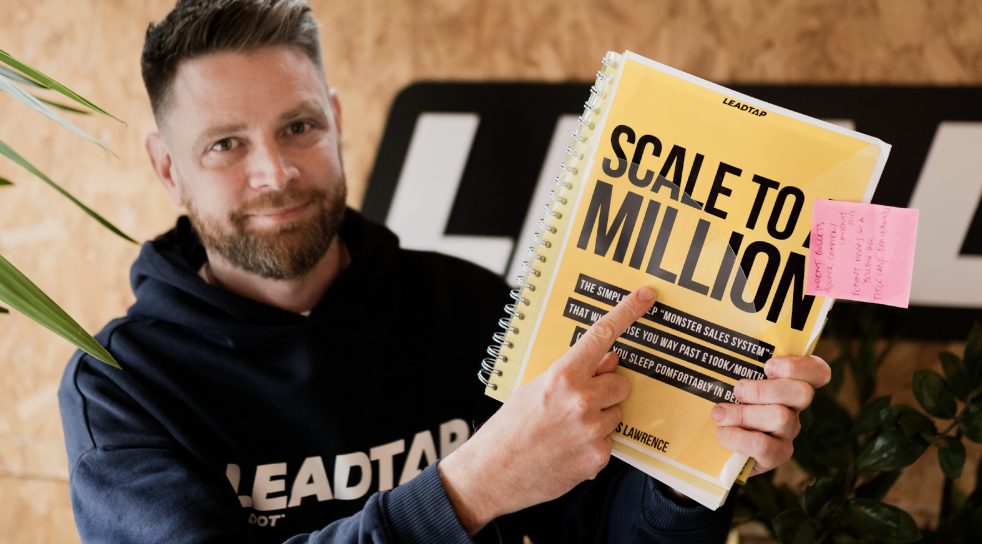

Recession-Proof Growth: How Louis Lawrence’s LeadTap® Method Has Replaced “Tired & Broken” Marketing Across The UK

LONDON, UK. December 4th 2025 – When the economy...

eflow Global Upgrades eComms Archiving and Surveillance for Financial Firms

eflow Global, a leading provider of regulatory compliance...

IPOs and ICOs: SOHO International Experts Explain Everything You Need to Know

Many people who follow financial news eventually come...

Digital Omnibus: A Turning Point for EU Data Policy and an Opportunity for European Analytics Providers

Piwik PRO, recognised across Europe for its privacy-first...

AstraZeneca Shares Dip 0.7% Amid Patent Cliff Fears, But Pipeline Strength Fuels Long-Term Optimism

Thursday saw AstraZeneca PLC shares decline 0.7% and close...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin