The Relationship Between Income, Lifestyle and Savings in the UK

A salary figure in the UK rarely tells the full story. Two...

How UK Professionals Are Rethinking Financial Stability

A generation ago, financial stability in the UK was often...

From Buffets to Blackjack: The True Cost of Visiting Las Vegas in 2026

For years, Las Vegas built its reputation on being...

Raban Al Safina – RAS Group’s Facility Management Services

Raban Al Safina (RAS) Group was founded in 1997 in Baghdad,...

The Small Business Owner’s Complete Guide to E-Invoice Software: From Paper Chaos to Digital Efficiency

E-invoice software replaces paper invoices with secure...

275,000 Traders Liquidated as Bitcoin’s Four-Month Losing Streak Deepens

By the time the dust settled on January 29, 2026, 275,000...

How American Freelancers Navigate Switzerland’s Tax Maze Without Triggering Two Governments

Every franc you invoice in Switzerland must answer to two...

Why UK Founders are Turning to American Buyers—And What it Takes to Get There

As domestic M&A activity stalls, a new pathway to...

How to be Exceptional in a Competitive Medical School Application Process

Applications for medical school are cutthroat; there are...

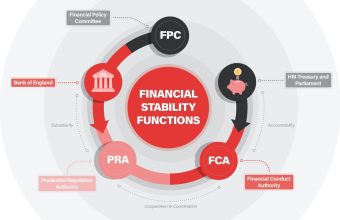

The Role of Regulation in Protecting UK Financial Users

The first time I sat in a dull, high-ceilinged room in...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin